HVUT pre-filing season has begun for the 2023-24 tax season – pre-file today with eForm2290!

Attention truck owners and fleet operators! It's time to gear up for the pre-filing season and get ahead of the game for this tax year's Heavy Vehicle Use Tax (HVUT) filing. If you want to avoid the stress and potential penalties of waiting until the last minute, read on for everything you need to know about how to pre-file 2290.

What is Pre-filing and when does it start?

The pre-filing season for the tax year kicks off on May 1, 2023 until June 30, 2023. This period grants you a chance to pre-file 2290 in advance. Why is pre-filing worth your attention? Well, there are numerous benefits and advantages to early filing that you simply can't afford to miss out on.

Most truckers and other members of the trucking industry are usually filing their HVUT, starting July 1, when the HVUT official tax season begins. This can result in longer wait times and less time to address potential errors or delays that may result in costly penalties. That's where the Pre-filing season comes in as a lifesaver — allowing you to file your IRS form 2290 in advance not only gives you peace of mind, but it also comes with several benefits that you don't want to miss out on.

Benefits of pre-filing season

Pre-filing your IRS form 2290 with eForm2290 can be a game-changer for truck owners and fleet operators. Here are some benefits to help you understand why pre-filing is a smart choice:

Timely compliance: By pre-filing, you can complete your HVUT filing before most people even start. This ensures timely compliance, and you won't have to worry about missing the deadline or facing any stress or anxiety that comes with it.

No more penalties: Filing your IRS form 2290 on time reduces the chances of late payments, which can result in hefty penalties. Avoiding penalties saves you money and hassle.

Time to correct errors: Pre-filing gives you ample time to address and correct any errors or objections in your filing. This can save you from severe penalties and help you avoid unnecessary stress.

Easier support: During the pre-filing season it is easier to get support, without having to wait for a long time. If you are someone who truly values time and likes getting things done in advance, then pre-filing is the best time to complete your HVUT filing.

More time for important things: Checking off your HVUT filing from your to-do list can be a big relief, allowing you to focus on important things such as your business, planning your next pickup, taking a vacation, or spending time with your loved ones.

If you're wondering how to pre-file form 2290, we’ve got you. Our platform offers numerous benefits such as a user-friendly platform, and top-notch customer service rated 5 stars on Google and Trustpilot. With over 4,000 positive reviews, you can trust that eForm2290’s customer support team will help you with your IRS form 2290 pre-file. Plus, pre-filing early with eForm2290 means you can take advantage of exclusive discounts on pre-filing fees, allowing you to save even more. Choose eForm2290 for a stress-free pre-filing experience that you can trust.

How to pre-file form 2290?

Pre-filing your form 2290 with eForm2290 is very simple. Here is how you can do it:

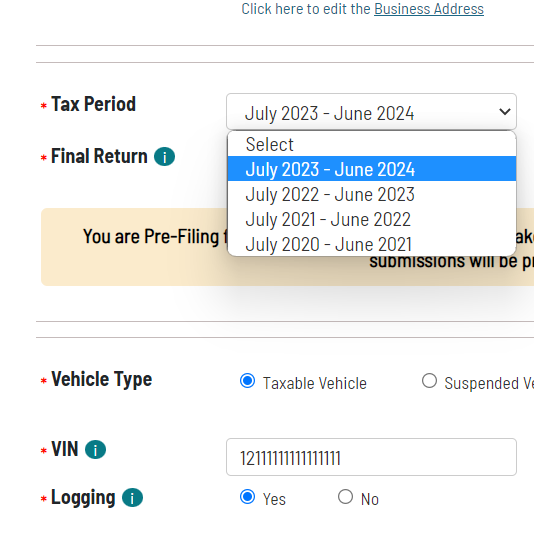

- Visit our eForm2290 and log in to your account.

- In case you do not have an account, you can create a new account in less than a minute.

- Once you've set up your account, enter your Business Name & EIN.

- Select the tax period & first used month.

- Choose the vehicle type and enter Vehicle Weight & VIN.

- On the next page, you can choose your preferred mode for IRS payment.

- Review your filing and complete the payment process.

- Once submitted, eForm2290 will transmit your filing to the IRS.

When Will You Receive Your Schedule 1 Form?

Receiving your Schedule 1 form from the IRS on time is crucial for the registration and operation of your heavy vehicle so that it can keep moving on public roads. When you choose to pre-file 2290 with eForm2290, you gain the advantage of being among the first to receive your stamped Schedule 1. The IRS begins processing HVUT filings for the 2023-24 tax season starting on July 1, 2023. As soon as the IRS approves your filing, you can expect to receive your stamped Schedule 1. This puts you ahead of the game, as you receive your Schedule 1 before many other truckers and fleet operators.

Don't miss out on the chance to simplify your Form 2290 filing for the 2023-2024 tax year. Take the leap and complete your IRS form 2290 pre-file today, allowing you to enjoy the summer without any worries.